Options Trading Secret #2: Weekly or Monthly Options?

Secret 2: Weekly vs Monthly Options…

Which should I trade?

When talking about stock options there are many common questions that come up. Which strike price should I trade? Should I buy or sell the options? Should I use weekly or monthly options?

The reason these questions can be tricky is that there is no perfect answer that fits every situation. It all depends on your outlook and what you are looking to accomplish with that trade.

Let’s talk about the different expiration cycles in more detail. Over the past few years, weekly options have become very popular with traders because in most cases they provide a cheap way for the retail trader to get into a trade.

These options expire every Friday, which means they are great products for traders looking for quick movement in the stock or ETF. With the cheaper price many traders view the weekly’s as safer trades.

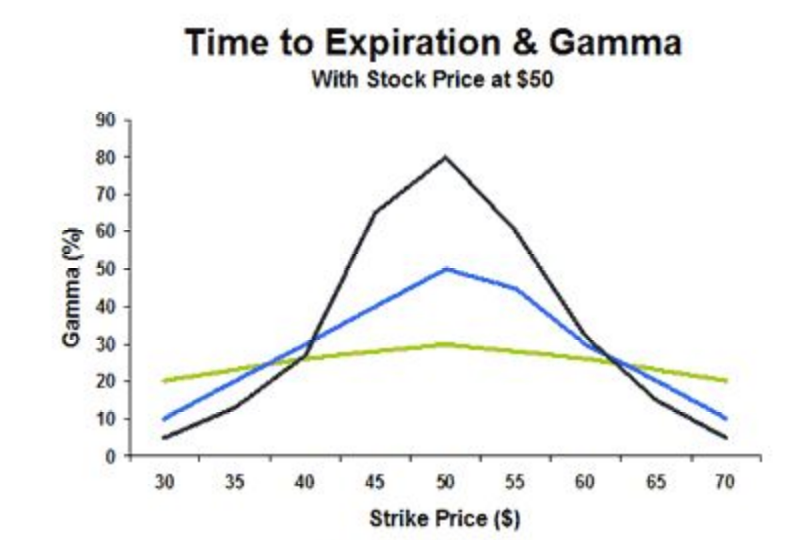

However, are they always the best products to use? When deciding whether we should use the weekly or monthly options, it depends on our outlook for the stock or ETF. If we are expecting a quick move within the next few days, then the weekly options will give us the most bang for our buck. This is due to the fact that Gamma, or directional risk, is higher the closer we get to expiration (see chart below).

As a result of the higher gamma in the weekly options, the price of those options will react quicker to movement in the stock. The key take away here is we will see more powerful moves as long as the move happens quick enough.

However, options are decaying assets which means the longer we hold them the more time value comes out. The weekly options will allow us to make money faster if we get a quick move in our favor.

The problem here is if the trade takes longer than anticipated the time decay will hurt our position very quickly. The weekly options just don’t give us much margin for error.

With this in mind, I recommend using more monthly options. Even though you will pay more when trading the monthly options, you are building in a safety net just in case the trade doesn’t happen as quickly as anticipated.

Our sweet spot is to look for options with between 20-40 days left to expiration.