Options Trading Secret #3: Buying In the Money Calls & Puts?

Secret 3: Trade the In-The-Money Options Buying Calls or Puts:

When buying a long call or put we need to make sure we have a strong opinion on which way the stock or ETF is headed in the near term. We have to keep in mind that whenever we buy an option the clock is ticking the second we decide to initiate the trade.

The time decay will start to add up and potentially eat into the profit potential that we have. This means not only do we need to be right on market direction, but the move needs to happen in our favor quick enough.

To combat some of the negative features of buying an option, we like to be very picky with the criteria that we use when selecting the call or put option.

First, we don’t pick the option based on what we can afford like so many retail traders make the mistake of doing. In many cases, this will leave you with an out of the money option which has a very low probability of success.

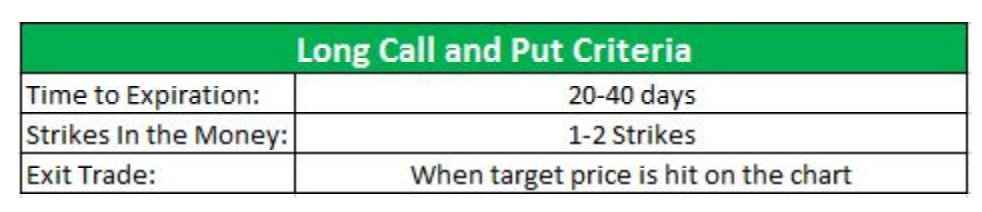

Instead, we like to trade the in the money options. Our criteria has us going out 20-40 days until expiration and buying the call or put option that is 1-2 strikes in the money. This criteria is the same whether we are trading GOOGL, DIA, or C.

By using the same criteria on all stocks and ETF’s, we are able to take much of the discretionary decisions out of the equation.

Buying Vertical Spreads:

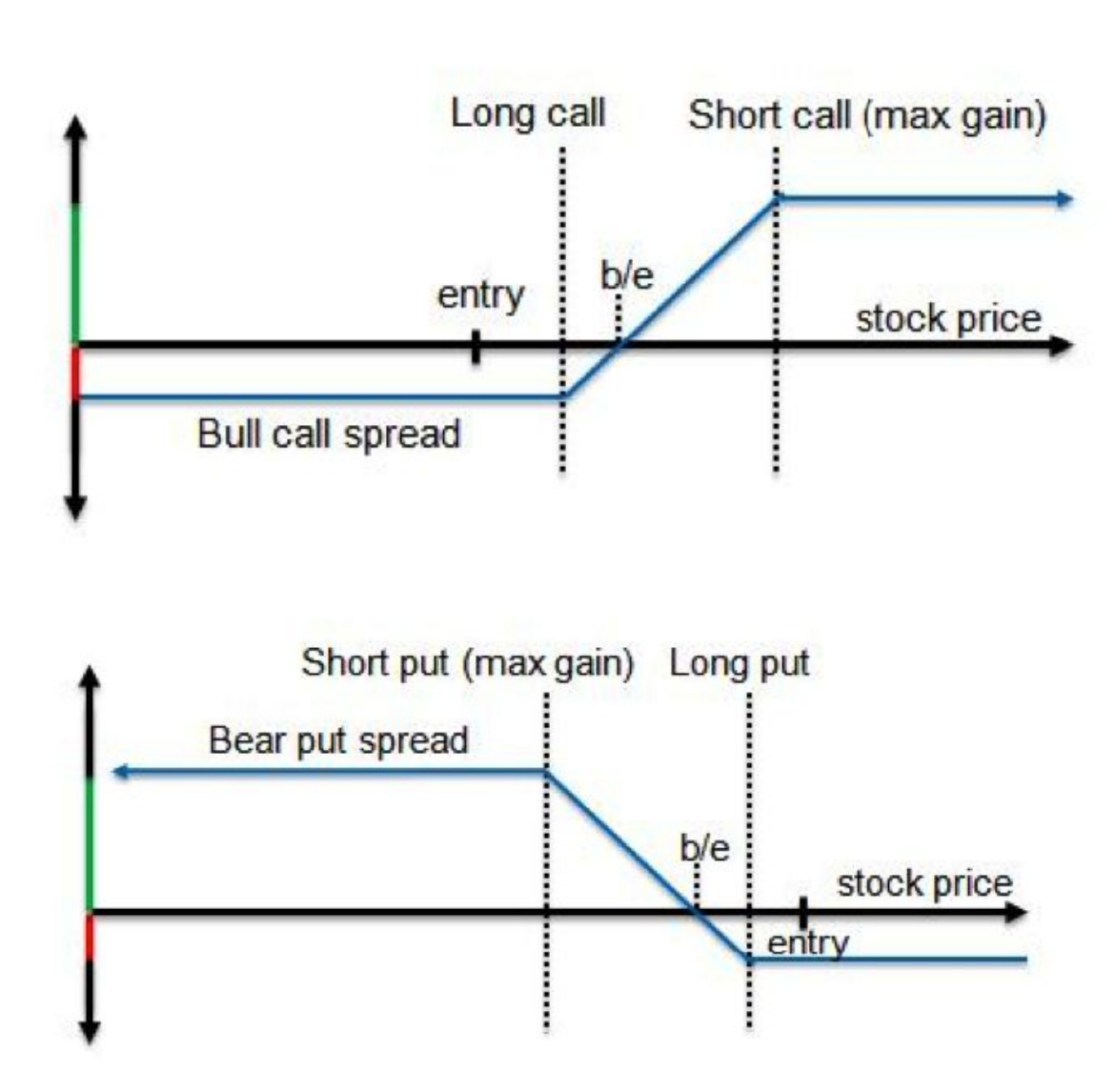

When using a long vertical spread, we still need to have a strong opinion on which way the stock or ETF is heading in the near term. While the time decay is still going to be there like with a long call or put, the long vertical spread is able to limit the effect of the time decay slightly.

We like to use the long vertical spread when we desire to be in a more conservative position. We are able to do this because a long spread is constructed by both buying an option and selling an option with a different strike price at the same time.

Vertical spreads offer a unique ability to control risk and reward by allowing us to determine our maximum gain, maximum loss, break-even price, maximum return on capital, and the odds of having a winning trade, all at the time we open a position.

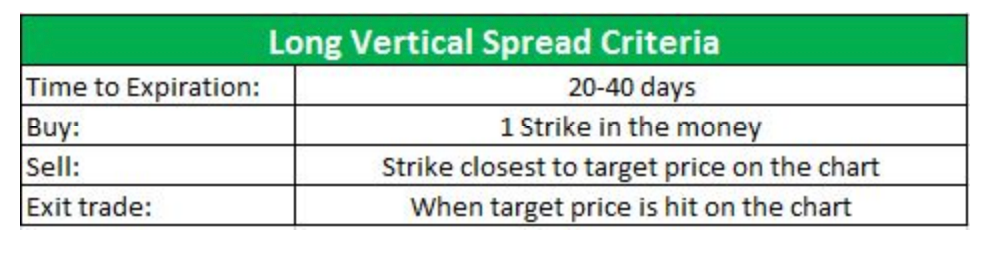

When setting up a long vertical spread we still like to trade the options that have between 20-40 days left until expiration. We structure the trade by always buying the option that is 1 strike in the money and then selling the strike that is closest to our target for that stock or ETF in the near term.

The nice part about using this simple criteria is that it is the same when using call or put options. The criteria is also the same regardless of the symbol of the stock we are trading.

o why wouldn’t we trade a spread on every trade?

While it’s great that vertical spreads limit the risk, they also limit the profit potential at the same time. Our profit is limited to difference between the strike prices minus what we paid for the trade.

For example, if we are putting on the long 25/30 call spread that would have us buying the 25 call and then selling the 30 call. This leaves us with a $5 wide call spread. If we paid $2.00 for the spread our maximum profit potential would be $3.00.

This is calculated by taking the $5 difference between the strikes and subtracting the $2.00 price that we paid for the spread. Many newer traders get intimidated by trading spreads because they think they will be left with huge risk. However, in reality the long vertical spread is actually safer than buying an outright call or put.

The reason for this is that we can never lose more than what we paid for the vertical spread. It is a defined risk trade. This is due to the fact that we are buying the option that is one strike in the money and at the same time offsetting some of that cost by selling the option that is farther out of the money.

As a result we are able to lower the overall cost of the trade. The long vertical spread is one of my favorite trade types and should be a part of your overall options toolbox.